see all jobs

US Senate questions charitable status of museums and galleries

The US Senate’s Finance Committee has questioned whether or not some private galleries and museums are exploiting their tax-exempt status for personal gain, querying whether or not they should be receive the government subsidy.

The committee said it recently contacted a dozen museums, including the recently-opened US$140m (€123m, £91.6m) Broad Museum in Los Angeles, requesting a number of facts and figures, including visiting hours, donations, trustees, valuations and arts loans – part of a wider effort to re-evaluate institutions that receive tax-exemption.

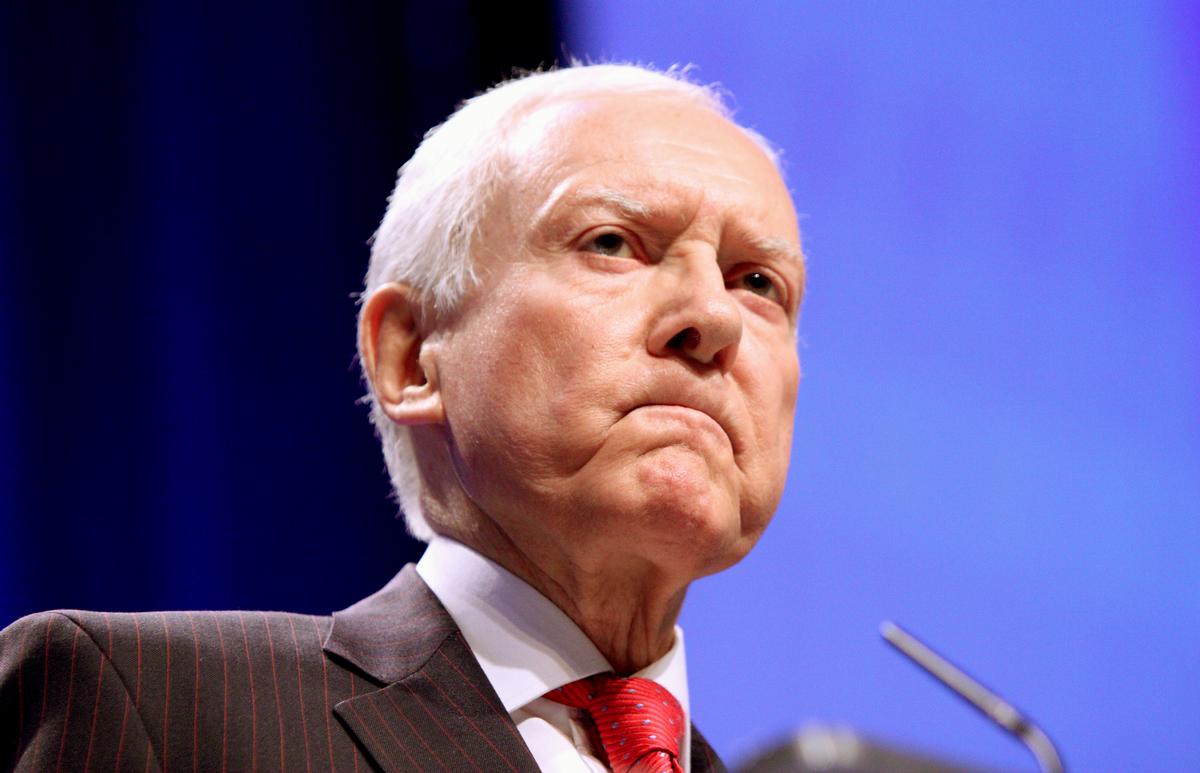

“Tax-exempt museums should focus on providing a public good and not the art of skirting around the tax code,” said Senate Finance Committee chair, Orrin Hatch in a statement.

“While more information is needed to ensure compliance with the tax code, one thing is clear: under the law, these organisations have a duty to promote the public interest, not well-off benefactors.”

With the art market in a state of growth, it has been suggested by financial analysts that many wealthy individuals are converting their personal collections into either private charitable foundations or into museums as a way to offset costs and reduce substantial tax bills. Current US regulations mean charitable organisations can buy artworks and artefacts tax-free, which also applies to the insurance, conservation and storage of those works.

Senator Hatch added in his statement that “charitable organisations play an important role in promoting good in our society,” but also questioned whether “some private foundations are operating museums that offer minimal benefit to the public while enabling donors to reap substantial tax advantages.”

The Committee’s spokesperson, Aaron W. Forbes added to Hatch’s statement that “the panel’s concerns are confined to a small number of private foundations and are not something that is symptomatic of a larger problem in exempt organisations.”

Existing Internal Revenue Service (IRS) guidelines are vague in establishing the level of public benefit necessary to justify an institution’s tax-exempt status, something the committee wants to address. As a minimum, public access and adequate signage are both considered prerequisites, while there are strict rules against displaying art in a donor’s own home.

More News

- News by sector (all)

- All news

- Fitness

- Personal trainer

- Sport

- Spa

- Swimming

- Hospitality

- Entertainment & Gaming

- Commercial Leisure

- Property

- Architecture

- Design

- Tourism

- Travel

- Attractions

- Theme & Water Parks

- Arts & Culture

- Heritage & Museums

- Parks & Countryside

- Sales & Marketing

- Public Sector

- Training

- People

- Executive

- Apprenticeships

- Suppliers