see all jobs

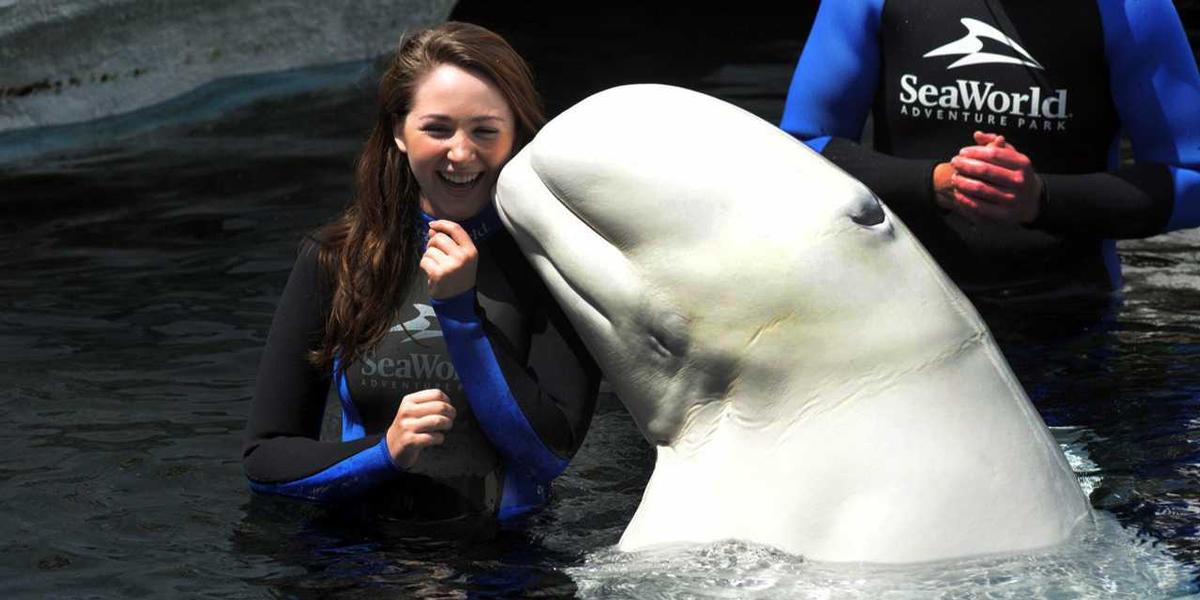

SeaWorld shares rally after activist investor group takes significant stake

SeaWorld has enjoyed a 5 per cent increase in its share value after activist investor group Ivory Cove disclosed a notable stake in the company.

Ivory Cove, a group that includes Joe Lewis and Adam Cyrus of Tavistock Group, and Greg Taxin of Lima Asset Management, revealed last week that it now owns 4.7 million shares of common stock equivalent to 5.2 per cent of SeaWorld – making it the third-largest shareholder in the company.

Billionaire Lewis – who owns Premier League football club Tottenham Hotspur – is the main investor in the group, with his stake in Ivory Cove at 4.6 million shares. Taxin – known as an activist investor – earlier this year spoke about the need for “new direction” on the SeaWorld board. Later in the year former CEO Jim Atchison left the SeaWorld board, while veteran theme park industry executives Ron Bension and Donald Robinson were appointed to roles at the head of the company.

SeaWorld’s share value rose above the US$14 (€12.50, £11) mark for the first time since early August following the filing by Ivory Cove, which indicated the group had engaged in conversations with SeaWorld management on business strategy.

To read an exclusive interview with SeaWorld CEO Joel Manby about the company’s new direction, read the latest issue of Attractions Management, available now.

More News

- News by sector (all)

- All news

- Fitness

- Personal trainer

- Sport

- Spa

- Swimming

- Hospitality

- Entertainment & Gaming

- Commercial Leisure

- Property

- Architecture

- Design

- Tourism

- Travel

- Attractions

- Theme & Water Parks

- Arts & Culture

- Heritage & Museums

- Parks & Countryside

- Sales & Marketing

- Public Sector

- Training

- People

- Executive

- Apprenticeships

- Suppliers