see all jobs

Darling downgrades growth predictions and hikes tax on alcohol

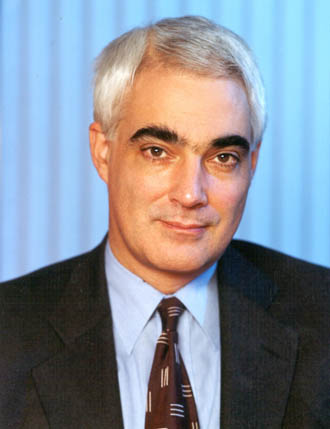

Alistair Darling has today announced his first budget as chancellor of the exchequer.

In an hour-long speech he set out the government’s spending plans over the next years as well as announced a number of changes in taxation affecting the leisure industry.

While Darling claimed that the UK was better placed than other global economies to weather any financial storm during 2008, he was forced to cut the forecast for predicted growth by 0.25 per cent to 2.5 per cent for the year.

The government’s aim of curbing binge-drinking will have a direct effect on the hospitality industry, as the chancellor announced above-inflation rises on the duties on beer (4p per pint), wine (14p per bottle) and cider (3p per pint).

The largest increase was levied on the price of spirits, a 55p per bottle increase. It is the first time in nine years that the tax on spirits has gone up.

The sports sector had been lobbying for the government to extend GiftAid so it would be available to Community Amateur Sports Clubs (CASCs).

There was no mention of this in the budget and Brigid Simmons, chief executive of Business in Sport and Leisure (BISL) aired her disappointment.

She said: "Not one word in the Budget’s Red Book on sport, so while you can still claim Gift Aid to visit bricks and mortar as a member of the National Trust, you cannot claim it as a sports club on children’s subscriptions."

The tourism sector will be pleased to hear that Darling announced measures to introduce the wider use of biometric data at airports to speed up processing travellers.

However, to many analysts’ surprise, there was no mention of a change in passenger duty.

Darling said his budget would ‘equip Britain for the future’ and announced that the government would do its utmost to help small and medium sized enterprises (SME).

He increased the tax relief on small businesses and announced extra investment in the Small Firm Loans Quarantee Scheme.

However, the overall rate of corporate tax is only set to fall to 28 per cent – as previously announced – despite the Confederation of British Industry (CBI) lobbying hard for a reduction to 18 per cent.

The controversial plans to change the Capital Gains Tax (CGT), revealed in the pre-budget report last year, will also go ahead.

It means that the so-called taper relief, which currently allows investors to pay just 10 per cent tax on investments held for more than two years, will be scrapped and replaced by a flat rate of 18 per cent.

It is feared that this could stunt growth of small and medium sized businesses.

Leisure industry leaders have reacted to the budget with mixed feelings.

Bob Cotton, chief executive of the British Hospitality Association (BHA), said: “Apart from the increase in alcohol duties, which is obviously not helpful and will hurt pubs more than hotels and restaurants, the Budget was largely neutral for the hospitality industry - but, as so often in these events, the devil may be in the detail.

“We certainly welcome the ntention to enable more small and medium sized firms to tender for public sector contracts and the promise to simplify the Corporation Tax calculations.”

The British Beer and Pub Association (BBPA) was not as gentle.

Rob Hayward, chief executive, of BBPA said: “The millions of people who enjoy beer have just been hit by a £50.5m a month tax raid on their family budgets.

“By aiming a tax hike at beer, the chancellor is shooting himself in the foot. Treasury revenues will continue to fall, pubs will continue to close and beer sales sink further.”

More News

- News by sector (all)

- All news

- Fitness

- Personal trainer

- Sport

- Spa

- Swimming

- Hospitality

- Entertainment & Gaming

- Commercial Leisure

- Property

- Architecture

- Design

- Tourism

- Travel

- Attractions

- Theme & Water Parks

- Arts & Culture

- Heritage & Museums

- Parks & Countryside

- Sales & Marketing

- Public Sector

- Training

- People

- Executive

- Apprenticeships

- Suppliers